About UOB Kay Hian (M) Sdn. Bhd.

- Leading independent regional equity house, providing services to both institutional and private clients in Southeast Asia.

- Headquartered in Singapore and Exchange participant in 7 regional markets: Singapore, Hong Kong, China (Shanghai B shares), Thailand, Malaysia, Indonesia, and the Philippines.

- Strong global sales and distribution team in 10 countries in Asia, UK and North America, with over 1,600 dedicated professionals serving Asia-Pacific equities.

- Leader in IPOs on SGX: #1 Underwriter / sub-underwriter, placement / sub-placements in terms of number of deals (2004 - 2012).

- 35% associate company of the United Overseas Bank (“UOB”) Group.

- UOB Kay Hian Malaysia has wholly owned subsidiary called UOB Kay Hian (M) Sdn. Bhd.

- Acquired Innosabah Securities Berhad on 3 May 2012

- Acquired A.A. Anthony Securities Sdn Bhd on 16 January 2013

- Acquired Standard Financial Adviser on 4th May 2020

- A Wealth Management Distribution Channel of UOB KayHian Malaysia.

- An Approved Financial Adviser (FA) and Islamic Financial Adviser (IFA) of Bank Negara Malaysia.

- A Capital Market Service Licensed Entity of Securities Commission Malaysia.

- UWEALTH is a comprehensive platform that offers a wide range of unit trusts and services to our Clients and designed to streamline the investment process for financial advisors.

- By offering access to a various unit trust funds, along with a variety of value-added services, UWEALTH helps advisors manage client portfolios more effectively.

- Through one point of contact, not only will you have access to over 1000 unit trust funds, you will have access to important services such as consolidated statements, Multicurrency Support, research tools, transactions management, web and mobile capabilities access.

UWEALTH's platform provides unbiased investment recommendations and research advice to help financial advisors make well-informed decisions for their clients.

- Independent Research and Analysis from a neutral perspective, focusing on the performance and suitability of different investment options for clients.

- Wealth Management product which included diverse Selection of Funds among 1,000 funds from multiple fund houses and Bonds. Investment Management products which included Customised Structure Product, Discretionary and Non-discretionary Managed Portfolio

- Tailored Investment Recommendations with unbiased research in order to create personalized investment strategies based on clients' risk tolerance, goals, and time horizon.

- Web-based and Mobile App capabilities for Financial Advisors and clients to view holdings, approve transaction, download statement anytime, anywhere.

- A comprehensive consolidate statement provide a holistic view of client's investment activities, performance, and holdings in one report.

Unit Trust

- Unit trusts are one of the most common investment vehicles, pooling investors' money to invest in a diversified portfolio of stocks, bonds, or other assets. UWEALTH offers access to a broad selection of unit trusts from various fund houses, providing financial advisors with a wide range of investment options.

- Ideal for clients who want diversification, professional fund management, and the ability to invest in a wide range of asset classes with relatively lower investment minimums.

- Good Liquidity as investors can generally buy or sell their units at the current Net Asset Value (NAV) of the fund, which is calculated daily or weekly depending on the fund.

- The value of a unit trust is determined by its Net Asset Value (NAV), which is the total value of the fund's assets minus liabilities, divided by the number of units in circulation.

Various type of Unit Trusts such as: Equity Funds, Bond Funds, Balanced Funds, Money Market Funds and Sector-specific Funds.

- Equity Funds:

- Objective: To provide long-term capital appreciation by investing primarily in stocks or equities (company shares)

- Investment Strategy: Focus on investing in the equity markets, either in a specific region (e.g., Malaysia, Asia, or Global) or in a specific sector (e.g., technology, healthcare, financials).

- Higher Risk Profile: Equity funds are generally more volatile than other types of funds due to the inherent risks of the stock market. They are subject to market fluctuations, economic cycles, and company-specific risks.

- Suitability: Best suited for investors with a long-term horizon who can tolerate market volatility and are seeking growth. Investors are typically willing to accept higher risk in exchange for higher potential returns.

- Bond Funds (Fixed Income Funds):

- Objective: To provide regular income and preserve capital by investing in fixed-income securities, such as government bonds, corporate bonds, or municipal bonds.

- Investment Strategy: These funds invest in debt instruments, which pay fixed interest over time. The value of the fund depends on the interest rates and the creditworthiness of the issuers.

- Moderate Risk Profile: Bond funds are generally less volatile than equity funds but can still be affected by interest rate changes, inflation, and the credit risk of the bond issuers.

- Suitability: Suitable for investors seeking steady income with a moderate level of risk. These funds are often favored by conservative investors or those nearing retirement who are more focused on capital preservation and income generation than high growth.

- Balanced Funds (Hybrid Funds):

- Objective: To provide both capital appreciation and income by investing in a mix of equities (stocks) and bonds (fixed-income securities).

- Investment Strategy: Balanced funds aim to provide diversification by blending different asset classes, typically with a specific allocation ratio (e.g., 60% equities, 40% bonds). The exact allocation depends on the fund’s investment strategy.

- Moderate Risk Profile: Since balanced funds hold both equities and bonds, they typically offer a middle ground between high-growth (equity) funds and low-risk (bond) funds. They provide the potential for higher returns than bond funds while offering more stability than pure equity funds.

- Suitability: Ideal for investors seeking a balance between growth and income, and who have a moderate risk tolerance. It is suitable for investors who want to diversify their investments across different asset classes but still have some exposure to equities for growth.

- Money Market Funds:

- Objective: To provide capital preservation and liquidity while earning a modest return, typically through short-term debt instruments such as treasury bills, certificates of deposit, and repurchase agreements.

- Investment Strategy: These funds invest in very short-term, high-quality debt instruments, often with maturities of less than one year. They are designed to offer low risk and easy access to cash.

- Low Risk Profile: Money market funds are considered one of the safest investments because they invest in low-risk, highly liquid securities. However, the returns are typically lower compared to equity or bond funds.

- Suitability: Best suited for investors seeking capital preservation, liquidity, and stability, and who are willing to accept lower returns. They are ideal for conservative investors or those who need a place to park cash for a short period (e.g., for emergency funds or for short-term savings).

- Sector-Specific Funds:

- Objective: To invest in a specific sector or industry, such as technology, healthcare, real estate, or energy. These funds target sectors that have specific growth opportunities or risks.

- Investment Strategy: Sector funds focus entirely on one industry or sector, investing in companies within that area. They can be highly focused on particular trends, technological advancements, or regulatory changes that affect the sector.

- High Risk Profile: Sector-specific funds can be more volatile and carry higher risk, especially if the sector experiences downturns. A fund’s performance is often tied to the fortunes of the industry it focuses on.

- Suitability: Suitable for investors who have a strong conviction about a specific sector and are willing to take on more risk for the potential of higher returns. It can be used by more sophisticated investors or those looking to diversify a larger portfolio.

The fees and expenses associated with unit trusts are important factors to consider when investing in these funds, as they can significantly impact your overall returns. Unit trusts typically involve several types of fees, each designed to cover the costs of managing and operating the fund.

- Annual Management Fees:

- This is the fee paid To the fund manager for managing the unit trust’s portfolio. It compensates the manager for making investment decisions, conducting research, and maintaining the fund’s operations.

- Management fees are typically charged as a percentage of the assets under management (AUM). The fee is generally deducted on a daily basis but reported on a monthly or annual basis in the fund's financial statements.

- Management fees usually range from 0.5% to 3% annually, depending on the type of fund (e.g., equity funds often have higher fees than bond or money market funds).

- Management fees is generally deduced from the fund's asset and you may find the Annual Management Fee in every Fund Propectus , Product Highlighted Sheet or Fund Factsheet

- Sales Charges (Entry Fees):

- Sales Charge also known as the front-end load, is the fee investors pay when they purchase units in the fund. It compensates the distributor / financial advisor for the sale of the fund.

- This fee is typically a percentage of the amount you invest. The sales charge is deducted from your initial investment before the remainder is used to buy units in the fund.

- Sales charges typically range from 0% to 5%, though some funds may offer discounts or waive the fee for larger investments or through specific distribution channels.

- The sales charge reduces the initial amount invested in the unit trust. For example, if you invest RM10,000 in a fund with a 3% sales charge, only RM9,700 would be invested in the fund.

- Redemption Fees (Exit Fees):

- A redemption fee (or exit fee) is charged when investors sell or redeem their units in the unit trust. This fee is designed to cover administrative costs and to discourage short-term trading.

- Redemption fees are charged as a percentage of the amount being redeemed.

- Redemption fees typically range from 0% to 3%, and they are usually lower than sales charges. Majority of funds do not charge redemption fees at all, while others may charge a fixed exit fees regardless of your investment amount eg: RM5

- Trustee Fee:

- The trustee fee is the fee paid to the trustee, who is responsible for safeguarding the assets of the unit trust and ensuring the fund operates in compliance with regulations and the trust deed.

- The trustee fee is generally a small percentage of the fund’s AUM, and it is deducted from the fund’s assets.

- Trustee fees are usually 0.05% to 0.1% of the assets under management annually

Income distribution in a unit trust refers to the way the fund distributes any earnings (such as dividends, interest, or capital gains) generated by its investments to unit holders. When a unit trust generates income, such as from dividends on stocks or interest on bonds, the income is typically passed on to investors, either through cash payments or by reinvesting the income to buy more units in the fund.

Bond

Bonds are debt securities issued by corporations, the government, or other entities to raise capital. When you invest in a bond, you're essentially lending money to the issuer in exchange for periodic interest payments (called coupons) and the repayment of the principal (the face value) when the bond matures

- UWEALTH is able to source for bond on behalf of client

- Pricings are indicative in nature; actual pricings might differ

- Purchase in minimum Odd Lot, eg: RM250,000. (Standard Lot is RM5mil corporate, RM10mil MGS)

All bonds purchases are under nominee services.The coupon payments will credit into the respective currency cash account automatically upon receipt from issuers. Generally, it takes 1 - 5 working days to process the coupon payment.

Discretionary and Non-Discretionary

Discretionary and Non-Discretionary accounts are two types of portfolios where the level of control and decision-making differs between the investor and the fund manager

A Discretionary Account is one where the investor delegates full decision-making authority to the fund manager or investment manager. This means the fund manager has the discretion to make buy, hold, or sell decisions on the investor's behalf without needing to consult the investor for each transaction. Fund manager makes investment decision base on clients' risk profile and investment objectives.

- Fund Manager's Authority: The fund manager has full authority to manage the investment portfolio, selecting assets, and making adjustments based on market conditions, investment objectives, and strategies outlined in the mandate. This allows the manager to react swiftly to changing market environments without waiting for approval.

- Portfolio Management: The fund manager creates and manages a diversified portfolio on behalf of the investor, usually based on an investment mandate. The portfolio may include assets like stocks, bonds, unit trusts, and other financial instruments.

- Investment Strategy: The fund manager operates within the investment objectives and risk profile agreed upon with the investor (e.g., conservative, balanced, or aggressive strategies). The goal is to align with the investor’s long-term objectives while making strategic decisions based on market opportunities.

- Ongoing Monitoring: Fund managers continuously monitor the portfolio’s performance, making adjustments as needed to meet the investor's goals. This could involve buying, selling, or rebalancing assets within the portfolio to optimize performance.

In a Non-Discretionary Account, the investor retains full control over the investment decisions, and the fund manager acts in an advisory capacity, making recommendations or offering products based on the investor's risk profile, investment objective and goals. The investor is the one who approves every buy or sell decision. In this context, Non-Discretionary Accounts often involve Customized Structured Products and Dual Currency Investment (DCI), both of which are tailored to the specific needs of the investor.

- Investor Control: The investor has full control over the investment decisions. The fund manager or advisor provides recommendations or investment strategies, but the investor makes the final decision on each transaction.

- Customized Structured Products: In a non-discretionary account, investors may choose to invest in customized structured products, which are tailored financial instruments designed to meet specific investment needs, such as capital protection, enhanced yield, or exposure to particular asset classes. They combine traditional asset classes (stocks, bonds, commodities) with derivatives (options, futures, etc.) to create a unique product that provides specific risk-reward profiles. This product is only suitable for High Net Worth client and Sophisticated Investors.

| Aspect | Discretionary Account | Non-Discretionary Account |

|---|---|---|

| Decision-Making | Full control is given to the fund manager. | Investor makes final decisions, but may receive advice. |

| Portfolio Management | Actively managed by fund manager. | Investor controls portfolio, may choose customized products. |

| Investment Products | Managed portfolio (unit trusts, stocks, bonds). | Customized structured products, DCI, or other tailored products. |

| Investor's Role | Passive role, provides risk profile and goals. | Active role, approves each investment decision. |

| Risk Profile | Based on investment mandate set by the investor. | Base on investor preference objectives and goals, but the investor remains actively involved. |

| Fund Manager’s Role | Complete authority to make investment decisions. | Provides recommendations but does not make decisions. |

ACCOUNT OPENING

Visit our investor centre to open your trading account. Our main branch is located at:

Sri Hartamas Office:

N-1-3,Plaza Damas, 60 Jalan Sri Hartamas 1, Sri Hartamas, 50480 Kuala Lumpur

8:30am to 5:30pm

Mondays to Fridays (excluding public holidays)

Alternatively, you can also visit any of the UOB Kay Hian branches during their banking hours.

For more information, you can:

- Contact our Customer Service at +603 6205 6000 during operation hours

- Email your enquiries at mycustomerservice@uobkayhian.com

| Citizenship | Documents Required |

|---|---|

| For Malaysian Citizen | Identity Card (Blue) |

| For Malaysian PR | Identity Card (Red) |

| For Foreigners | Valid Passport |

It takes approximately 1-3 working days to process the account opening application, depending on circumstances.

You are required to visit any of our respective branches to update your address for your investment account. Alternatively, you may contact your respective Financial Advisor to submit the Updating of Account Particulars form and mail the original duly signed form to us.

Login & Security

Step 1: Access our homepage at https://www.uwealth.com.my

Step 2: Click "Login" button which located at the top right area of the webpage.

The UWEALTH Platform will automatically prevent someone from logging into the system if an incorrect user ID or password is used. Please take note of the following:

- The caps lock, as the password is case sensitive.

- You have keyed in the correct user ID and password.

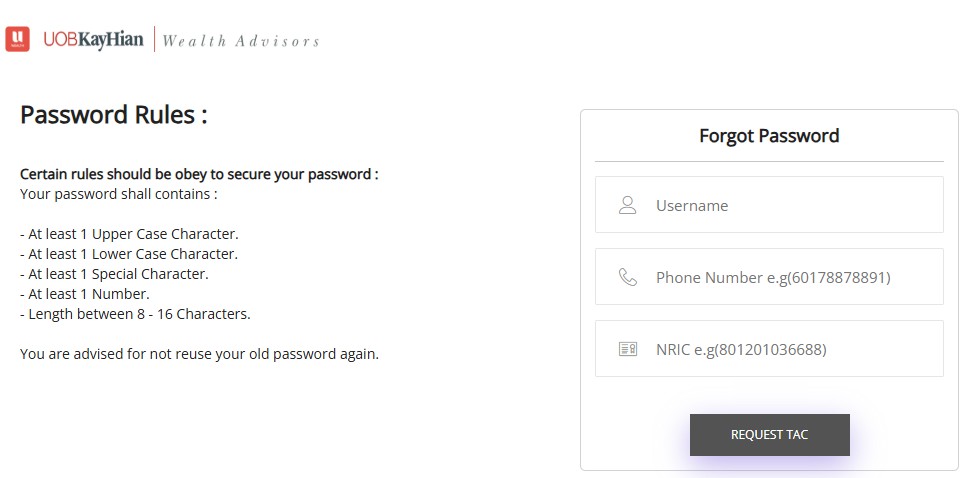

Please click "Forgot Password" to reset a new password.

*Take note to include digit 6 infront the Phone Number column

For your protection, your Online Account will be blocked after 3 unsuccessful login attempts.

Please click "Forgot Password" to reset

Alternatively, you may contact your respective Financial Advisor to assist on your locked account or contact our Customer Service

at +603 6205 6000 during business operation hours

Transactions

| Product | Transaction Type | Cut-Off Time |

|---|---|---|

| Unit Trust | Online / Offline (Paper) | 3:00 PM (Except Money Market Fund) |

| Bond | Offline (Paper) | 5:00 PM |

| Discretionary | Offline (Paper) | 5:00 PM |

| Non-Discretionary | Offline (Paper) | 5:00 PM |

- Most of the unit trust funds in Malaysia are priced based on "Forward Pricing". This means if you transact today, the value of the fund will be as of today’s closing price for the market, and this only is reflected 1 or 2 working days later.

- What you see on the website is the unit trust “indicative price”. This is the price of the fund 1 or 2 working days ago. This indicative price is NOT the actual dealing price of the fund that your client is buying or selling at.

- Generally, the fund manager requires approximately 2 business days to consolidate and derive a unit price for the funds. These prices are further valued independently by the fund's trustees. Therefore, the dealing price will be made known to the public 2 business days after the transaction date. Once we obtained the price, an email notification will be sent to you.

All orders submitted before the cut-off time* on a business day will be transacted on the same day and will be completed within 7 business days (T+7) from the day they are transacted.

Yes, you can login into Client account and select "Holdings" > "View Holdings"

No, all transaction need to create by your Financial Advisor.

Yes, you can consolidate the fund holdings from another distributor and/or financial institution into UWEALTH Platform. Please contact your respective Financial Advisor to check on transfer procedure or contact our Customer Service at +603 6205 6000 during operation hours.

To exercise cooling-off rights, you will required to submit the Cooling Off Form to cancel within 6 business days of your buy transaction. Please contact your respective Financial Advisor to check on cooling-off procedure or contact our Customer Service at +603 6205 6000 during operation hours.